carried interest tax proposal

The legislative amendments effecting the Proposal will be introduced to the Legislative Council for passage in late January 2021. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried.

What The Proposed Tax Plan Means For Commercial Real Estate Voit Real Estate Services

The proposal provides that the concessional tax rate would apply on carried interest paid for management services provided in Hong Kong by.

. The carried-interest tax hike is part of the Democrats broad proposals to increase taxes on corporations and wealthy individuals to finance new spending on energy electric. Unlike previous proposals in other. Present law The Tax Cuts and Jobs Act added Section.

Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. Potential Negative Impact to the Charitable Sector The July 27 draft of the Inflation Reduction Act IRA includes a provision from the September 2021 Ways. Bidens proposal would have treated such gains as ordinary incomeraising the rate from 20 percent today to 396 percentfor any taxpayer earning 1 million or more.

The 2017 tax law passed by Republicans largely left the treatment of carried interest intact following an intense business lobbying campaign but did narrow the exemption. The proposal approved by the house ways and means committee in september which is part of a large tax and spending package currently being debated in congress aims to change the law to significantly modify the so-called carried interest loophole by limiting situations that are eligible for the more tax favored long term c See more. In the first months of his presidency Biden proposed a sweeping list of tax increases that would kick in for individuals earning at least 400000 a year including.

The top individual rate would be 396. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. To do that he said he would tax long-term capital gains at the ordinary top income tax rate essentially wiping away the special treatment of carried interest.

The carried interest provisions if now adopted are proposed to be effective for taxable years beginning after December 31 2022. Carried Interest Tax Proposal Threatens Charitable Giving Elizabeth McGuigan Sector Regulation October 28 2021 Last month the House Ways and Means Committee. The proposed carried-interest change would include some exceptions retaining the three-year holding period for real property trades.

At most private equity firms and hedge. The private equity industry has defended the tax treatment of carried interest arguing that it creates incentives for entrepreneurship healthy risk-taking and investment. Managers with a holding period of less than five years would incur short-term capital gains tax rates on carried interest a 37 top rate the same that applies to wage and.

Carried Interest Tax Proposal. It is proposed that the tax concession will.

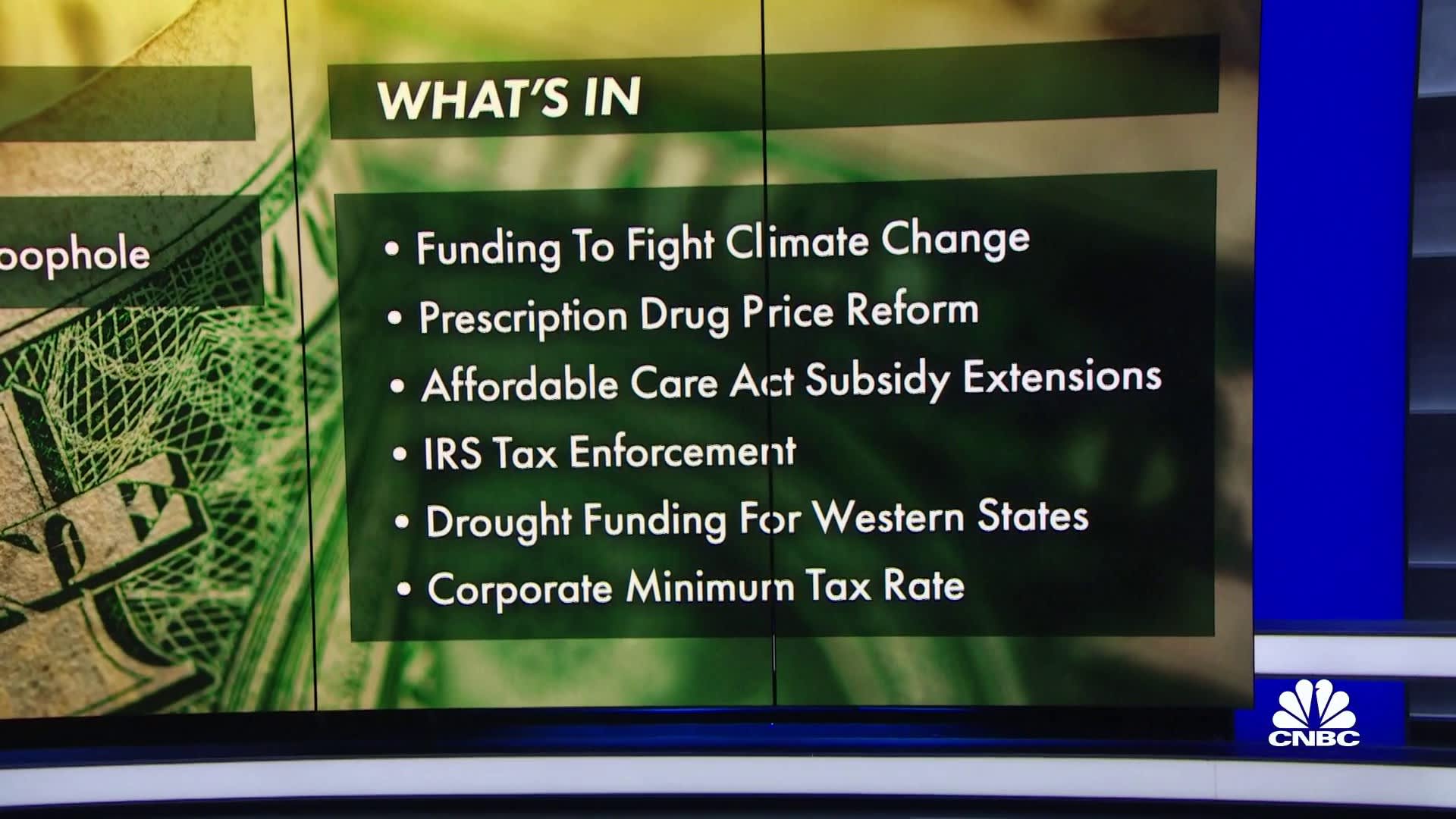

Carried Interest Tax Loophole Part Of Manchin Inflation Bill

The Carried Interest Loophole Survives Because This Whole Tax Plan Is The Brainchild Of A Human Loophole Dealbreaker

Summary Of Fy 2022 Tax Proposals By The Biden Administration

What Is Carried Interest And How Is It Taxed Tax Policy Center

Crystal Gazing A Look At The Presidential Candidates Major Income Tax Proposals Pearl Meyer

Possible Federal Tax Law Changes On The Horizon

Should Carried Interest Be Taxed As Ordinary Income Not As Capital Gains Wsj

Debunking Fiscal Myths There Is No Loophole For Carried Interest

Op Ed Carried Interest Proposal Would Stifle Investment In American Businesses Taxpayers Protection Alliance

Carried Interest Tax Break For Private Equity Survives Another Attempt To Kill It Barron S

Carried Interest And Other Tax Reform Highlights For Investment Funds And Asset Managers

Biden Administration Tax Proposals Implications For Commercial Real Estate United States Cushman Wakefield

Builder Associations Oppose Carried Interest Tax Reform Chicago Agent Magazine Associations

How Did The Tax Cuts And Jobs Act Change Business Taxes Tax Policy Center

States Are Taking Aim At Pe S Carried Interest Loophole Pitchbook

Carried Interest In Private Equity Calculations Top Examples Accounting

Sinema Made Schumer Cut Carried Interest Piece Of Reconciliation Bill

Tightening Carried Interest Loophole May Not Choke Private Equity Firms After All Wsj